what is a good apr for a car lease

Use a rate between 2 and 5 if you have strong credit between 6 and 9 for average credit and between 10 to. Used car loan rates.

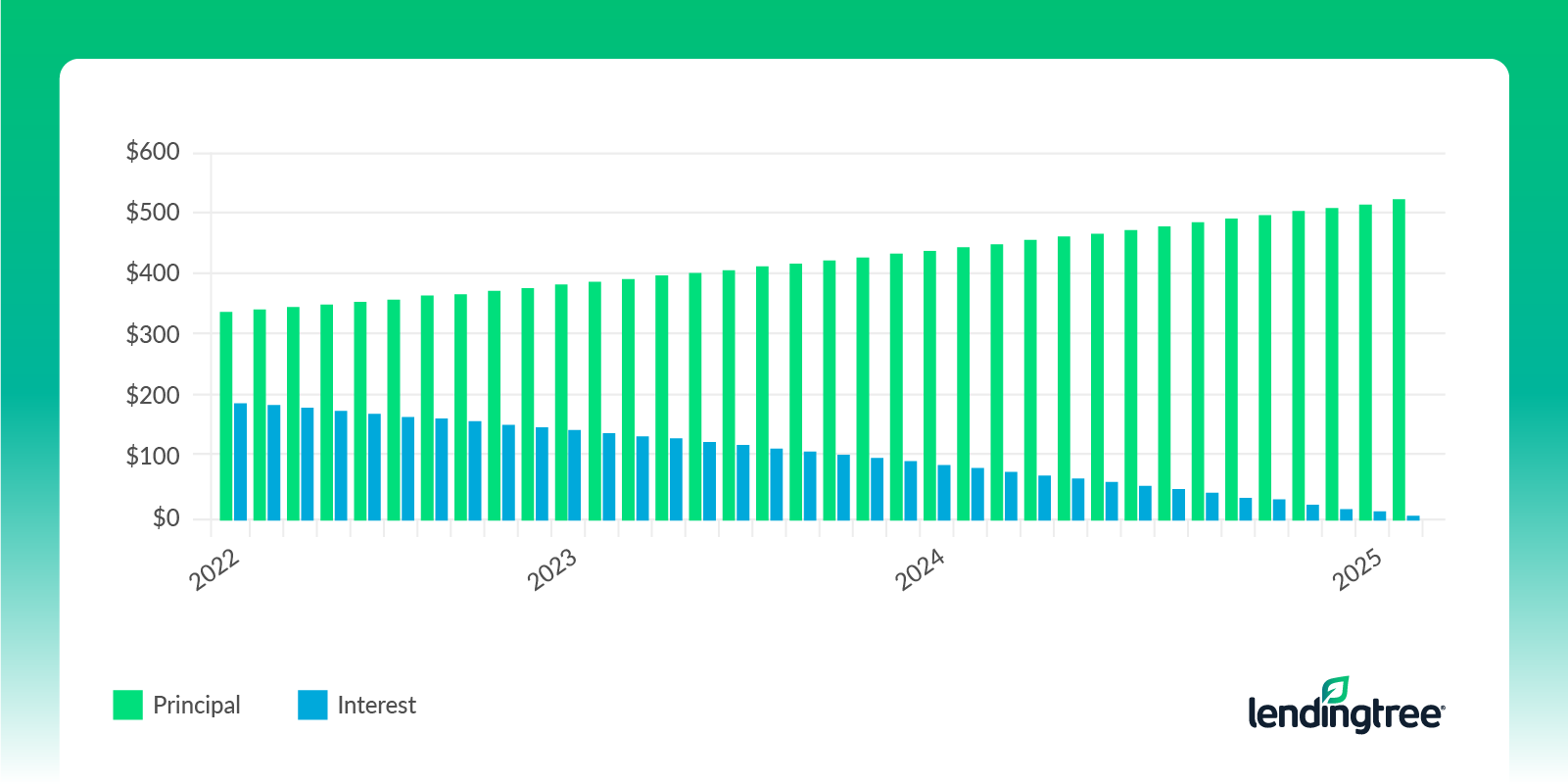

What Are The Different Types Of Auto Loans Lendingtree

You have flexibility to change cars every few years.

. Lease transfer service Swap-a-Lease says dealers typically receive commissions of between 1 and 6 percent. Someone with a solid credit history and excellent credit is likely to have access to the best rates on the market and in that case the 5 figure we mentioned earlier might be a. 1130 percent for new 1155 percent for used 782 percent for.

A lease deal with a. Credit scores of 740 or higher whats considered very good will help you qualify for the. Money factor 5500 3400021000 x 36.

Fair 650 - 699. A good APR is like interest rates one that is as low as possible. The average car loan interest rate was 386 for new cars according to Experians State of the Auto Finance Market report in the fourth quarter 2021.

Those with a credit score between 781 and 850 saw an average new car interest rate of 24 in the first. These are the average auto loan rates by state as determined by Edmunds data. If you have good credit 700-749 the average auto loan rates are.

People leasing a new vehicle in the third quarter of 2020 had an average credit score of 733 according to Experian data. To see your annual percentage rate APR you multiply it by 2400. An auto loans interest rate will depend largely on your credit score.

The actual interest rates you can qualify for vary depending on your credit rating the loan. You can likely lease a car for a lower monthly payment than buying. Good 700 - 749.

FICO considers scores of 670 and above to be. If you can get a rate under 6 for a used car this is likely to be considered a good APR. Click on a state to view the APR for different vehicle types.

They can vary widely depending on several factors but there are some things you can do to lower your APR on a car loan. For those with a high credit score a rate lower than 234 would be considered above average but if your credit score falls below 500 getting an APR lower than 14 would be. The total monthly fees are 5500.

A money factor is going to be expressed as a decimal such as 00056. If youre a business owner you may. Car loan interest rates change frequently so its important to keep track of them.

For used cars the average. 506 percent for new 531 percent for used 506 percent for refinancing. Use the toggle to see the avg.

A lease with a 0056 money factor. If you have excellent credit 750 or higher the average auto loan rates are 507 for a new car and 532 for a used car. Thus a money factor of 0025 works out to an APR of 6 percent.

What is a good APR for a car lease. The car lease term is three years or 36 months with an estimated residual value of 2100. Pros of leasing a car.

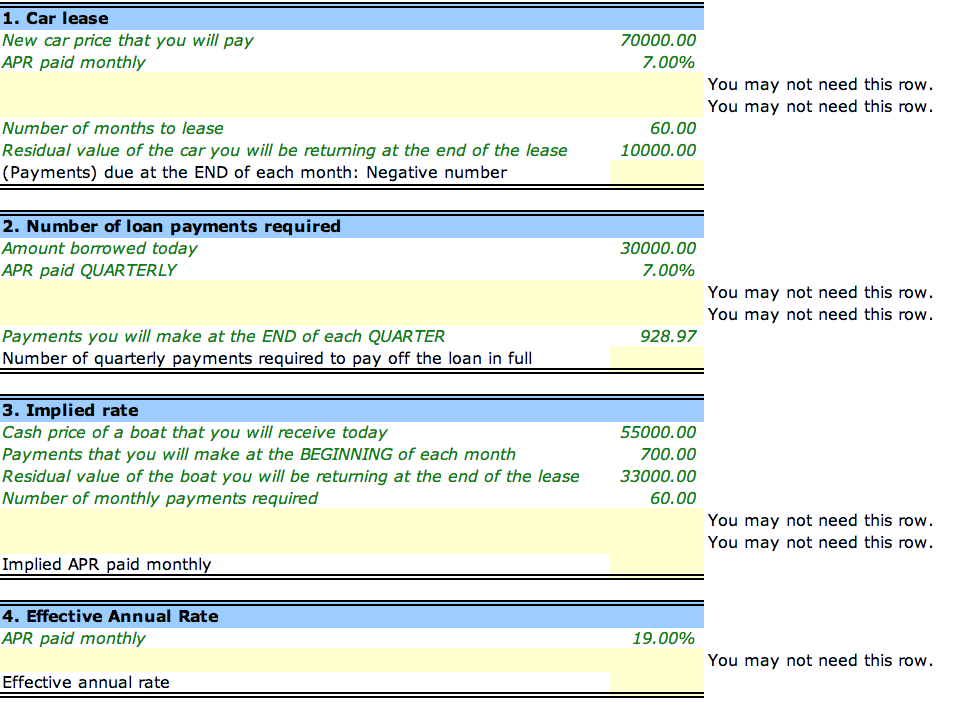

Solved 1 Car Lease New Car Price That You Will Pay Apr Paid Chegg Com

9 Car Leasing Traps You Should Avoid Bankrate

Toyota Lease Deals Raleigh Nc Near Durham New Car Specials

What Credit Score Is Needed To Buy A Car Lendingtree

Best 0 Apr Financing Deals Right Now

Audi Lease Deals In Warrington Pa Best October 2022 Offers

What S A Money Factor On A Lease Carsdirect

What Happens When A Car Lease Ends You Have More Options Than You Think Capital One Auto Navigator

Best Car Deals Lease Finance 0 Apr And Cash Back Deals Autotrader

Special Honda Lease Plans Barbour Hendrick Honda

What Is A Good Interest Rate For Your Car Loan Planet Honda

Honda Lease Deals In Philadelphia Pa Offers Valid Thru 10 31 22

What Is A Good Apr For A Car Forbes Advisor

What Does Apr Mean In A Car Loan Broadway Auto Credit

Auto Loans And Leases Indiana Members Credit Union

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Understanding Interest Rates Vs Apr For Car Loans Rategenius

When Should You Lease Your Car Here S The Best Time To Do It Shift

Edmunds With Low Interest Rates Should You Lease Or Buy Ap News