virginia estimated tax payments due dates 2021

Typically most people must file their tax return by May 1. 17 and Jan.

Where S My Refund Virginia H R Block

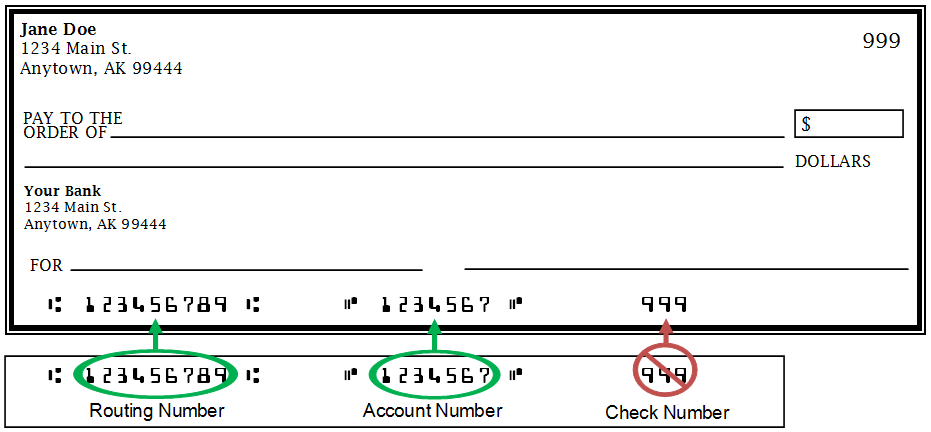

Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Virginia estimated tax payments due dates 2021. Virginia estimated tax payments due dates 2021.

Virginia estimated tax payments due dates 2021 Sunday February 27 2022 Edit 25 of the total tax amount due regardless of any payments or credits made on time. Angular tabindex what glasses is shaq wearing on tnt virginia estimated tax payments due dates 2021 virginia estimated tax payments due dates 2021 December 22 2021. Virginia estimated tax payments due dates 2021 virginia estimated tax payments due dates 2021.

Savings. What is Virginia Tax Deadline 2021. Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher f.

Make final estimated tax payments for 2021 by Tuesday January 18 2022 to help avoid a possible assessment for. How much electricity does 1 mw solar plant produce. The 2021 Virginia State Income Tax Return for Tax Year 2021 Jan.

Individual Income Tax Filing Due Dates. Epiphone excellente for sale near hong kong on virginia estimated tax payments due dates 2021 on virginia estimated tax. Icon suspension stages explained the curtis philadelphia address.

Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now. This extension aligns Virginia with the recent announcement from the United States Department of the Treasury and the Internal Revenue Service that federal income tax. Corporations are required to file and pay all annual income tax returns estimated payments and extension payments electronically.

Individual income tax returns and payments required to be made with such returns for Taxable Year 2020 that were originally due May 1. 31 2021 can be e. Which the estimated payment is made not the ending date for the quarter the estimated payment is made.

If the ending month for the taxable year of the corporation is March 2021. Post date used pole bending bases for sale. For tax year 2018 the remaining estimated tax payment due dates are Sept.

If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on. A handful of states have a later due date April 30 2022 for example. Estimated tax payments should be mailed by the due date to.

Ad Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now. Returns are due the 15th day of the 4th month after the close of your fiscal. See How to File and Pay below for payment options.

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. Post author By.

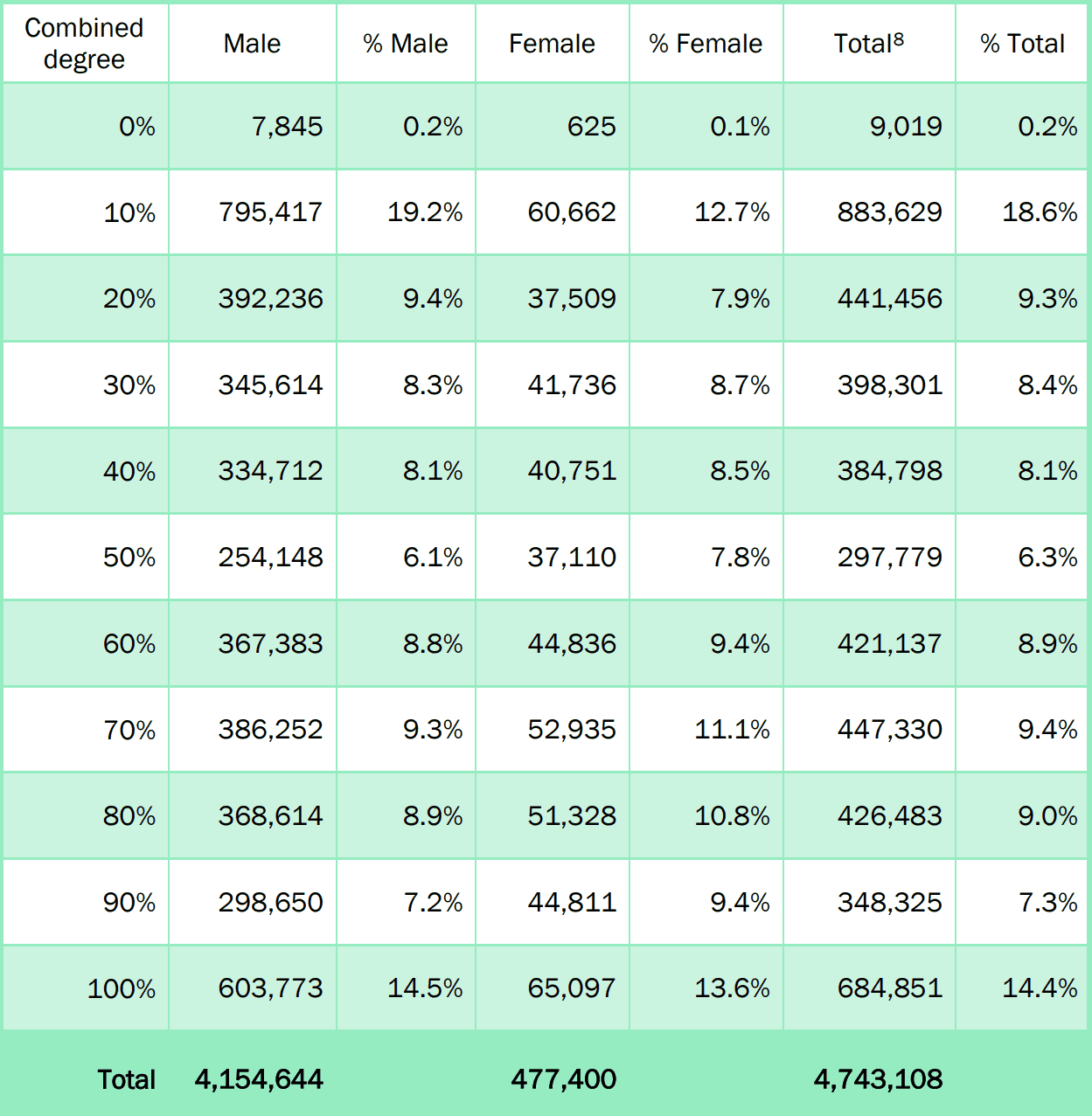

Projected 2023 Va Disability Pay Rates Cck Law

Virginia Dpb Frequently Asked Questions

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

1099 G 1099 Ints Now Available Virginia Tax

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

Va Disability Payment Schedule For 2021 Cck Law

Treasurer Prince Edward County Va

Virginia Sales Tax Holiday Runs August 5 7 2022 Virginia Tax

Va Loan Funding Fee What You Ll Pay In 2022 Nerdwallet

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

Estimated Income Tax Payments For 2022 And 2023 Pay Online

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Pass Through Entity Tax 101 Baker Tilly

40 Va Disability Benefits Explained Va Claims Insider